Dear Fellow Shareholders and Associates:

Kimco has always been about people. So much of Kimco’ s rich history and success is due to the vision, leadership and work ethic of key individuals who have joined with me to make Kimco what it is today; namely, the premier owner of retail shopping centers in the United States. From time to time over the years, I have extolled the virtues of some of these individuals who have played such a large role at Kimco. Marty Kimmel, Mike Flynn and David Samber immediately come to mind, but there are many others. With Dave Henry’s announced retirement and Conor Flynn’s appointment by the Board of Directors to succeed Dave as our next CEO, I thought it appropriate to focus my remarks on these two unique individuals.Dave’s retirement is bittersweet for me. On the one hand, I am saddened that Dave’s smile, upbeat personality and calm demeanor will no longer be part of our day at Kimco. In his 14 years at Kimco, Dave has been a trusted partner, mentor and friend, and was instrumental in guiding our transformation over the last few years. He will be sorely missed. On the other hand, I smile with thoughts that Dave will now finally have the time that he has rightfully earned to do all the things in life that he enjoys, but has put off for so long. He leaves us with wonderful memories of his time here, and we wish him nothing but the best. And we look forward to his continued assistance and advice as we call upon him to serve from time to time in the future.

And now Conor. I am thrilled with the Board’s selection of Conor to succeed Dave. Kimco is part of Conor’s DNA as he follows in his father’s footsteps. Conor’s father, Mike, has been a Kimco officer, advisor and friend of mine for many, many years. And Conor brings the same energy and passion for our business that his father brought. He is bright, analytical and articulate. Conor is a wonderful motivator and has an innate leadership ability that is both rare and refreshing. I believe the company will thrive under his leadership, and I look forward to joining him as he takes Kimco to higher and higher levels.

In addition to Conor, Kimco is blessed with a group of talented professionals that are smart, dedicated and committed to Kimco’s future success. Conor has assembled a young team that is limited only by their own imagination. At the same time, Conor is also surrounded by some very seasoned and respected managers and advisors, including Glenn Cohen, our CFO, Bruce Rubenstein, our General Counsel, and a slate of regional presidents who are second to none, and who each manage portfolios that could easily stand alone as separate companies.

Finally, no letter of mine would be complete without a word about our portfolio. A particularly unique source of value creation in our business has excited me from the very beginning of my career, and still does today. By their nature, shopping centers require a very high ratio of land to total value. The typical shopping center is comprised of a one-story building and five times as much land as the square footage of the building’s footprint. The land component often exceeds the parking requirements, and thus, becomes an additional asset. In a growing economy, land is one of the best and least risky long-term investments. It is irreplaceable, indestructible, and a natural hedge against inflation. And as the land increases in value, it allows the center’s extra land to be set aside, or land banked, as I like to say, for additional investment opportunities. In the meantime, the revenue generated from the improvements covers the real estate taxes and other carrying costs.

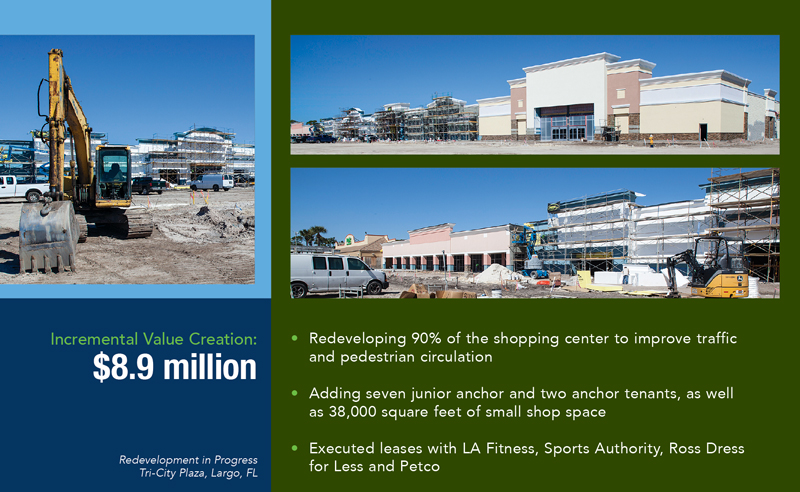

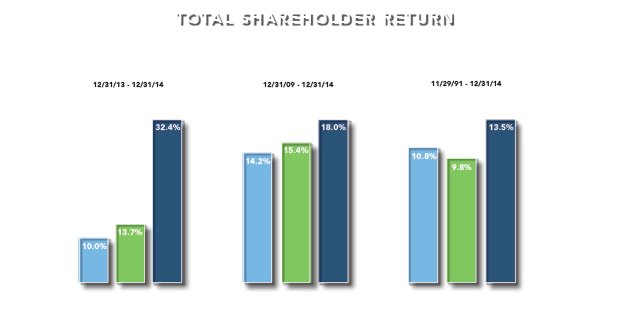

Today, the opportunities that land banking affords us can take many forms, including the expansion of existing centers, development of outparcels, sales to third parties, and possibly mixed-use development. As markets change and evolve, it is incumbent upon us to make sure that we are maximizing each asset’s value, in order to maximize total shareholder return. In addition to our redevelopment projects spearheaded by Conor, we have, on occasion, drawn down from our land bank to unlock additional value with a mixed-use concept. Where the opportunities for mixed-use projects exist, we are careful to make sure that any non-retail component enhances the primary retail component; it is this synergy that increases the overall asset’s value.

So, for example, in two quality centers in Washington, DC and Boca Raton, Florida, we are working with best-in-class developers to build residential developments on excess land that we believe will create more demand for our centers’ tenants, and overall, create more value and a better asset for the long term. Let me be specific: in Pentagon Plaza just outside Washington, DC, a 750-apartment project is under consideration. And in Boca Raton, we are looking at 300 residential units to complement our shopping center. We are also considering a smaller residential project in Columbia, Maryland, which we believe will further enhance our existing retail center. In another instance, in the Bronx, in a shopping center that lies in the shadows of Yankee Stadium, adjacent to the Bronx County Courthouse and Bronx Municipal Building and in one of the densest parts of New York City, we built, with a partner, on excess land that we own behind the retail center, a five-story, 67,000- square-foot office building. Our ability to unlock additional value in our current portfolio will play an important part in our future growth. And given the size of our portfolio and the length of ownership of many of our properties, some of which have been owned for more than 50 years, I am confident that we will continue to find value-creation opportunities within our portfolio.

Joe Namath, the iconic New York Jets quarterback of the late sixties once wrote a book titled, “I Can’t Wait Until Tomorrow…’Cause I Get Better-Looking Every Day.” While I can’t say the same about myself, I can say the same about Kimco and its future. We have great people, great assets and great opportunities ahead of us. We get better every day.

This is an interactive version of Kimco Realty's 2014 Annual Report. It is qualified in its entirety by reference to the printed version, a reproduction of which is available in PDF format above.

This is an interactive version of Kimco Realty's 2014 Annual Report. It is qualified in its entirety by reference to the printed version, a reproduction of which is available in PDF format above.